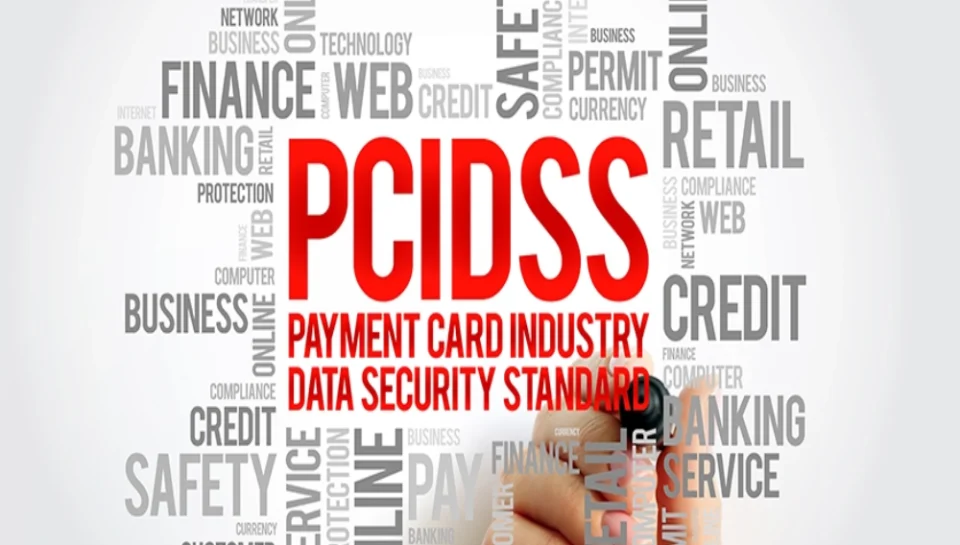

What is PCI-DSS compliance, and is it mandatory for Indian websites handling payments?

Definition and Purpose

- PCI-DSS stands for Payment Card Industry Data Security Standard.

- It is a global standard developed to protect cardholder data and secure payment systems.

- The standard applies to any organization that stores, processes, or transmits card data.

- It includes a set of technical and operational requirements to prevent fraud and breaches.

- PCI-DSS is enforced by major card networks like Visa, Mastercard, and RuPay.

Key Security Requirements

- Implement strong access controls to restrict card data to authorized personnel.

- Encrypt cardholder data during transmission and storage.

- Maintain firewalls, antivirus software, and secure system configurations.

- Conduct regular vulnerability scans, penetration testing, and security audits.

- Maintain logs of payment activity and monitor for suspicious behavior.

Applicability to Indian Businesses

- PCI-DSS is mandatory for all Indian websites and businesses handling card payments.

- It applies to e-commerce sites, payment gateways, mobile apps, and POS systems.

- Non-compliance can lead to termination of merchant services or financial penalties.

- Indian businesses using payment aggregators must still ensure their own environment is secure.

- The standard is especially critical for startups and MSMEs to ensure user confidence.

Legal and Regulatory Alignment

- While PCI-DSS is not a law, it complements data protection regulations like the DPDP Act.

- It is often required in audits or compliance checks by banks and regulators.

- Provides legal protection in case of disputes or security incidents.

- Many Indian financial institutions and payment processors require PCI-DSS certification.

- Businesses failing to comply risk losing their ability to accept online payments.

Benefits Beyond Compliance

- Enhances consumer confidence and reduces cart abandonment on payment pages.

- Minimizes the risk of financial fraud, chargebacks, and brand damage.

- Establishes a strong foundation for secure digital payment infrastructure.

- Improves internal security practices across departments.

- Facilitates international business and partnerships through recognized standards.